Platform home » Net Zero Delivery Vehicle

The Net Zero Delivery Vehicle is a proposed strategic partnership and governance structure between local authorities and private sector partners to accelerate and quality-assure the delivery of local net zero projects. The concept has been developed in conjunction with local authorities since 2021, and the core team has worked together since 2022 through funding from the Greater South East Net Zero Hub and Innovate UK Net Zero Living: Pathfinder Places project.

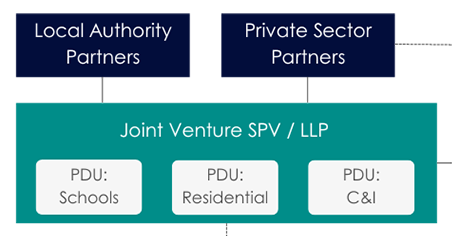

NZDV is a distinct legal structure that allows LA control and co-benefits from investment with private sector partners. Self-sustaining through market-standard development fees

Public Sector Partners contribute project portfolios and resources

Private Sector Partners will bring in expertise and a network of investors

The Managing Organisation (administered by ep group), serves as a single point of contact for stakeholders

Debt (public or private) may also be provided at project level

Procurement via existing frameworks reduces uncertainty and speeds up delivery

Stakeholder alignment at the PDU level reduces transaction costs for each project via scalable and replicable models

Project development units utilise best practices to aggregate, develop, and deliver projects across asset classes and local authorities.

The NZDV provides the following:

The NZDV is structured as a partnership between local authorities and the private sector. As greater risk often correlates with higher potential returns, the risk–reward sharing model will be tailored equitably to reflect the specific risk appetite of both public and private sector partners.

Primarily, local authorities will be expected to contribute:

Local authorities will also want to ensure compliance with public procurement procedures.

Local authorities are not obliged to provide investment capital.

The NZDV is a strategic partnership, and the governance structure between local authorities and private sector partners is designed to catalyse private finance into local net zero delivery in a way that is fair and equitable to all parties involved. Local authorities will have varying appetites for risks and rewards, therefore the NZDV can be structured to cater to specific local authority requirements to maintain strategic place-based policy influence, whilst ensuring transparency in operational decision-making.

Whilst the NZDV was initially designed to engage stakeholders within a two-tier government structure, it remains fully applicable in devolved areas. Under a devolved governance model, the NZDV would engage directly with the combined authority, enabling more streamlined decision making and helping to reduce transaction and administrative costs. The NZDV will need to re-align with the regional investment priorities outlined in the combined authority’s devolution deal and strategic frameworks. However, we anticipate that devolution will unlock opportunities for larger-scale, cross-boundary projects that have clearer delivery mandates and access to more flexible, multi-year funding arrangements – ultimately enabling faster and more coordinated project delivery.

The private sector has two roles:

The NZDV will require working capital to establish the vehicle and develop the first tranche of projects, with public sector grants anticipated to be the primary source. Thereafter, it will become self-funding through fees generated from completed projects.

Projects will be funded through a blended model of public and private investment, structured to provide market rate of return to the private sector whilst rewarding the public sector for its participation.

Projects or portfolios within the vehicle will be on a ‘look-through’ basis, and not cross-collateralised, in order to allow investors (public and/or private) to participate only in projects (asset classes or market sectors) for which they have the appetite.

By embedding social and environmental value throughout the project lifecycle, the NZDV can attract concessionary funding where available, such as from the Social Housing Decarbonisation Fund.

In the UK public sector, accounting principles are guided by both UK Generally Accepted Accounting Principles (UK GAAP) and International Financial Reporting Standards (IFRS). This framework includes several standards such as FRS 102, FRS 101, and FRS 105. FRS 102 is the main standard for most entities, providing comprehensive guidelines on financial reporting: It distinguishes between finance leases (on-balance sheet) and operating leases (off-balance sheet), with specific criteria for each. Other examples of off-balance sheet mechanisms can be joint ventures (unconsolidated), securitisation of assets or factoring of receivables.

The NZDV will work with local authorities and professional advisors to create an appropriate balance sheet treatment for investments.

The NZDV is structured as a partnership between local authorities and the private sector. As greater risk often correlates with higher potential returns, the risk–reward sharing model will be tailored equitably to reflect the specific risk appetite of each party to the partnership.

Equitability or a fair rate of return will be assessed using the Commercial Market Operator (CMO) principle.

This would depend on the policy objectives and investment priorities of the local authority. Previously, the NZDV has examined priority investments such as decarbonisation of schools, domestic building retrofits and SME net zero support, but project development units can be formed to address any asset class or sector.

The NZDV would use the five dimensions of the Impact Management Project framework for impact management, monitoring and reporting:

Incorporated in this approach are classic performance indicators such as carbon emissions reductions, cost savings and return on investment. Key metrics will be included in the management contract to ensure alignment of interests.?

We use cookies to ensure you get the best experience on our website.